No longer an item purchased only for visits to the beach or pool, today’s consumers understand that daily sunscreen usage is a valuable tool for maintaining overall skin health and helping to prevent signs of premature aging. The industry has evolved to better fulfill consumers’ needs for sun protection anywhere and everywhere with an array of formats and formulas.

Whether it’s a cosmetically elegant, light-weight lotion, an SPF stick for on-the-go touch ups, or foundation with SPF benefits, consumers want options for their range of sun care needs.

The global sun care products market grew from $12.96 billion in 2022 to $13.85 billion in 2023 at a compound annual growth rate (CAGR) of 6.9%, according to The Business Research Company. The growth is driven by growth in awareness regarding skin cancer and major skin concerns, and innovations in the industry. Due to the regulatory process in the US, the industry is currently limited in which active ingredients SPF formulations can include. While we impatiently wait for updates on both the regulatory process and the possible approval of a new ingredient, the industry continues to innovate within the currently set boundaries to provide consumers with the sun protection they need.

The sun care trends covered in this report fall into three categories: multifunctional, ingredients, and formats. Alongside these trends, science-backed solutions and sustainability continue to be a driving force for change and innovation across the beauty industry. In this report, we’ll take a closer look at how these trends are manifesting in the products on the market, and how brands can incorporate these ideas into their product offerings or extensions.

Multifunctional Sun Care

Playing a major part in the multifunctional trend we’re currently seeing in beauty; SPF can be found as an added benefit across many makeup and skin care products on the market today. Hair care has also begun to dip its toe in the sun care market with a variety of products to protect scalp skin and counteract the damaging effects of UV rays on hair health.

Brands and consumers are gravitating towards the products that offer the most coverage and provide convenience to their daily routines. Many consumers are using SPF cosmetics in combination with sunscreens, taking a multi-tiered approach that can offer additional sun protection.

MAKEUP

Consumers are getting their SPF protection where they can, and often layering up for additional protection. Mintel reports that 70% of consumers in the US use makeup with SPF regularly year-round. While we’re seeing SPF pop up in some unexpected products like eye shadow or highlighters, most of the SPF crossover is happening in foundation, primers and finishing sprays. The SPF foundation product segment dominated the global industry in 2022 and accounted for the maximum share of more than 23% of the overall revenue, according to Grandview Research. Brands and consumers are gravitating towards the products that offer the most coverage and provide convenience to their daily routines. Many consumers are using SPF cosmetics in combination with sunscreens, taking a multi-tiered approach that can offer additional sun protection.

SKIN CARE

Whether it’s skin care products with SPF benefits or sunscreen with skin care benefits, this cross-category collaboration is one that makes sense for both consumers and brands. With consumers becoming more aware of the role that sun protection plays in their skin’s overall health, sun care has also become a priority for consumers.

Due to the fluctuating economic conditions and consumers’ busy lives post COVID lockdown, we saw the emergence of the ‘skinimilism’ trend that reflected consumers’ desires to simplify their skin care routines with products that offer multiple benefits. Mintel reports that 48% of consumers in the US are interested in trying and willing to pay more for sun care products with added skin care benefits.

Currently, skin care benefits in sunscreen focus on concerns such as hydration, skin complexion and skin dullness with hero ingredients like Hyaluronic Acid, Niacinamide and Vitamin C. This may be due to their well-known and established skin care benefits. Brands have also expanded from these benefits to include elasticity, skin firming and skin barrier health with ingredients like bakuchiol, peptides and even probiotics. According to Mintel, a major driver to the growth in daily SPF adoption is preventing signs of aging with 69% of adults claiming to wear sunscreen for this purpose, which is an increase of 25% from 2021. Brands should explore formulations that help to prevent and counteract relevant skin issues to tap into consumers’ growing awareness of the connection between skin health and sun protection.

HAIR CARE

While hair may not get sunburned in the same way that our faces do, overexposure to UV rays can lead to frizz, split ends, dryness and the fading or discoloration of hair. There’s also opportunity for brands to create products that protect the skin on the scalp with scalp care being a growing subcategory in hair care as more consumers have become educated in how the scalp’s skin health is connected to their overall hair health.

Sun and hair care products generally focus on protection or treatment, both pre- and post exposure. For protection, sun care begins at the scalp. Related SPF products are often in a powder or spray format to have the ability to reach and protect the scalp. This is also still a growing subcategory in sun care with less product options on the market and lower consumer adoption to date as many consumers believe that their hair will protect their scalp or want minimal disruption to their overall hairstyle. There is an opportunity for brands to make a splash in this category with formulas that contribute to scalp skin health and don’t leave strands too greasy or gritty.

UV protection for hair differs from sunscreen for the skin because hair is made up of dead cells. So, the focus in sun care for hair (not the scalp) is on mitigating the aesthetic or functional effects of sun exposure to the hair. That means the ingredients and benefits are focused on antioxidants and plant-derived oils to help alleviate the effects environmental stressors, hydration for dry hair or frizz, heat protection and color protection. The protection of color treated hair and hair-color fading is a large part of this category, especially lighter-colored hair which is more susceptible to photo damage than deeply pigmented hair. Brands should explore treatments that work to strengthen hair to help hair combat exposure to the sun as well as post-exposure damage.

ANTIOXIDANTS AND ENVIRONMENTAL PROTECTION

Antioxidants are compounds that help prevent damage caused by free radicals and environmental stressors such as climate, pollution, etc. Vitamin C, vitamin E, and green tea extract are common antioxidants included in sunscreen formulas, but brands are expanding to create their own concoctions of plant-based antioxidants with ingredients like turmeric, pomegranate, goji extract, black elderberry, grapeseed and ginger, just to name a few.

Ingredients can be a marketing tactic to build on a brand story. For example, regional ingredients can reflect the cultural background of a brand’s founder or sustainable ingredients might reflect a brand’s prioritizing an earth-friendly supply chain. Antioxidants offer brands the opportunity to tout the additional benefits of a product beyond sun protection, while also making a statement about the brand. Brands should work with their formulation partners to identify the antioxidants that best fit their brand story and offer effective benefits for consumers.

BROAD-SPECTRUM PROTECTION

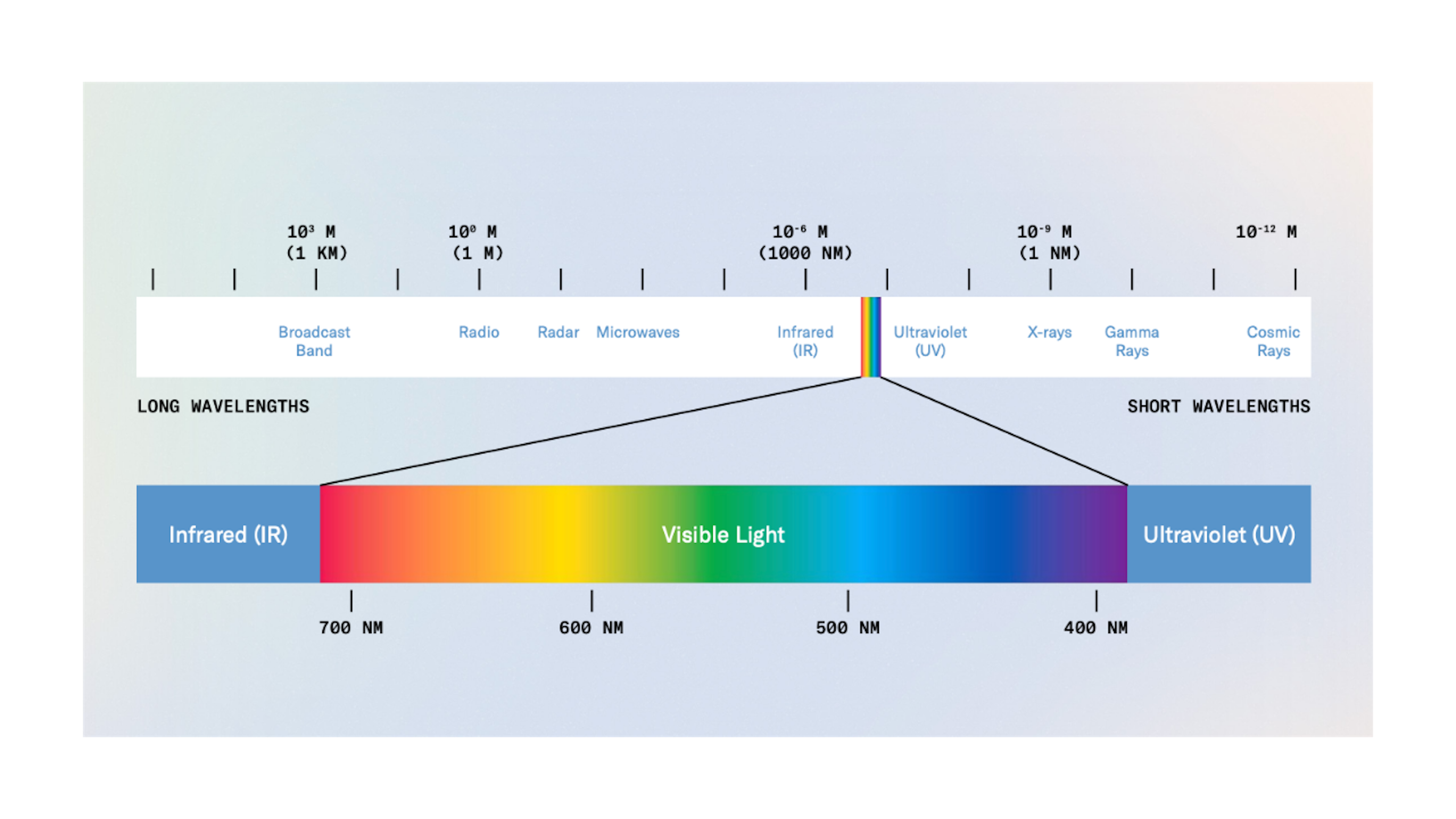

Broad-spectrum is the FDA regulated designation that we use to indicate that a product protects against both UVB and UVA rays. UVB rays are shorter and cause more immediate skin damage such as sunburn, while UVA rays are longer and penetrate deeper into the skin, which can lead to long-term skin damage and premature aging. The current regulations focus on protecting skin from the immediate effects (sunburns) and offer some protection from longterm damage but may not completely protect from the full spectrum of possible radiation.

For brands that are looking to develop a broad-spectrum sunscreen, Prime Matter Labs Chief Science Officer Jennifer Hurtikant advises, “Brands should work with a lab or formulator with expertise in sunscreens so that they can guide you toward the claims, like SPF factor or water resistance, that make sense for your brand and the type of product you would like to bring to market. They will also be able to coordinate the appropriate tests needed to support these claims. Another important factor is to identify the countries you plan to distribute in because each country or region has different regulations, and you want to formulate in compliance from the start. During R&D, brands should work with a regulatory expert to confirm compliance with all applicable countries. Simultaneously doing R&D and regulatory compliance is the most efficient way to prepare for an on time launch to the market.”

Ingredients

ACTIVE INGREDIENTS

American brands have been innovating within the bounds of our current regulatory system by improving on the ingredients available to the market and filling formulations with “boosting” ingredients to strengthen a products’ ability to protect skin. The FDA’s OTC monograph for sunscreens lists the active ingredients that formulators in the US are currently allowed to use. Most sunscreens currently sold in the US qualify as chemical or hybrid because they are less likely to leave a white cast and are generally thinner and more transparent. There has been increasing demand for mineral sunscreens formulations in recent years which has driven formulators to develop more elegant mineral sunscreens and provided brands with more options in how they approach sun protection. Brands should work with their partners to decide on which approach is best for their product. (Learn more about The Difference Between Mineral and Chemical Sunscreen)

On the regulatory front, there have been several potential active ingredients that have sought FDA approval over the years but there haven’t been any new UV filters added since avobenzone in 1996. Currently, there are efforts to get FDA approval for bemotrizinol, a broad-spectrum chemical ingredient used in many sunscreen formulations around the world, but approval isn’t expected until 2024.

BOOSTERS & BIOTECH

SPF boosters are ingredients in a sunscreen’s base formulation that can significantly increase the SPF efficiency but do not actually contribute to SPF value on their own. They can also be used to improve the resistance of formulations and reduce skin penetration. These ingredients include oil soluble and hydrophilic polymers, emollients, and waxes. They can also function by increasing the UV scattering ability of sunscreens, increasing the UVA coverage by extending the critical wavelength and improving the UV stability of sunscreens. Additionally, some antioxidants, like ferulic acid, are included because they may help to neutralize free radicals.

Boosters are beneficial if you know how to use them. It’s all about the synergy between ingredients. Prime Matter Labs Chief Science Officer Jennifer Hurtikant shares, “There are several natural and biotech derived SPF boosters on the market. Specialty ingredients derived from green coffee and cellulose have been proven to boost SPF values when low levels of sunscreens are used. When a product achieves SPF values with less sunscreen active ingredients, it helps to combat many of the issues that consumers have with sunscreen formulations. For example, mineral sunscreens have little or no white cast and chemical sunscreens are not as greasy and heavy.”

Biotech-derived ingredients are generally more consistent in quality and better for the environment because they do not rely on disrupting ecosystems and depleting resources. Currently, biotechnology has focused on creating alternatives to animal-derived ingredients, like squalene for squalene, and ingredients that have had negative environmental impacts, like palm oil, but this is still a developing area with the potential to revolutionize the sun care industry and create a new palette of materials. Jasmina Aganovic, CEO of biotech startup Arcae discussed the potential for biotechnology at a recent TEDx event where she said the industry could look to other forms of life for inspiration, “Marine life has phenomenal capabilities to protect itself from UV radiation. Fish, after all, do not get sunburned. Could this be an entryway into sun care that we love to use, that’s also sustainable and not extractive? It could mean better compliance of products and lower rates of skin cancer.”

Formats

Putting aside hybrid products like beauty or hair care that feature SPF, you can find sunscreens across almost every format imaginable: spray, stick, powder, lotion, serum, drops, gel, gel cream, foam or even whipped cream. Brands should work with their formulating partners to identify the best format and formulation for the target consumers’ needs.

As Prime Matter Labs Chief Science Officer Jennifer Hurtikant explains, “When working with brands to develop any product, we first need to understand the brand’s ethos and the purpose of the product they want to develop. Then R&D chemists will work with the brand to identify the best active ingredients and format for optimal delivery of the actives to the skin.”

They will also consider how the ingredients and formats will best fit with the total application, target audience’s needs and the expected use of the product.

SPF STICKS

While not a new concept, one format that is increasingly becoming popular is the SPF stick for its convenience and sustainability benefits. The stick format is an optimal format for on the-go application and reapplication throughout the day and is a great choice when targeting customers with a busy lifestyle. Another reason for their popularity is the growing waterless beauty trend. The global waterless cosmetics market size is expected to reach $16.4 billion by 2028, rising at a market growth of 10.1% CAGR during the forecast period. The increasing prioritization of sustainability, for both brands and consumers, makes this an attractive format. From a brand’s perspective, the waterless format provides additional benefits such as lower shipping weights that reduce carbon impact and smaller packaging that reduces waste.

TINTED SUNSCREENS

Tinted sunscreens continue to remain popular due to an increasing demand for sunscreens that work for more skin tones and the popularity of mineral sunscreens. Adding pigments to SPF formulas helps to combat the dreaded white-cast that continues to be an issue for some mineral sunscreen formulations and consumers with darker skin tones. According to Future Market Insights, the tinted sunscreen market in 2022 was valued at $980 MN and will go up to $1.67 BN in 2032 with an expected CAGR of 4.5% during the forecast period. Aligning with the multifunctional trend, this format can often be viewed as a cosmetic or skin care adjacent when offering varying degrees of coverage and added skin care benefits.

ADDITIONAL FORMATS

One trend we’re starting to see in sunscreens is thinner, more lightweight textures which can be found in drops, serums, gels or gel creams. These lighter textures may be easier to layer under makeup and allow for more versatility than the thicker lotions of the past. Powder sunscreens are an easy-toapply, portable format with a matte finish that are often found as setting powders. This format is not generally used as the primary form of sun protection but more for supplemental touch-ups throughout the day.

What's Next?

FRAGRANCE

Fragrance was one of the top performing categories in beauty in 2022 as consumers looked to add some luxury and self-care to their daily routines. Alongside the fragrance boom, we’ve seen several sun care brands achieve success by leaning into their signature fragrances. Fragrance in sun care has typically evoked tropical notes like coconut or an ocean breeze, but with sun care extending beyond the beach, brands have the option to explore various scents to set them apart from the competition.

Alternatively, while many sunscreens will have some fragrance to mask the chemical smell of ingredients, there is an increasing demand for sunscreen without scent due to a rising focus on sensitive skin and a desire to avoid layering competing scents.

Fragrances, or the lack thereof, can be a great tool for communicating a brand story. Brands should work with formulating partners to decide which approach works best for their target audience and the expected use of the product.

SKIN TONE DIVERSITY

The Black beauty consumer is underserved by the beauty and personal care market with only 13% saying it’s easy to find beauty products that meet their needs at a mass-market retailer or a grocery store, according to McKinsey. As awareness that all skin tones need protection from the sun has grown, so has the demand for sun care products for consumers with darker skin tones. According to Mintel, among the 49% of Black consumers who use sunscreen, 54% are applying sunscreen more often than they were a year ago, while 84% of Black sunscreen users say they wish there were more product options made specifically for their skin tones.

Black consumers are also more aware of how UV rays can lead to disruptions in skin health or early signs of aging like sagging of the skin, loss of volume in the face, and hyperpigmentation. While people with lighter skin tones tend to see fine lines and wrinkles, people with melanated skin may see changes in pigmentation that lead to melasma, or dark patches, and uneven skin tone because of sun damage. Sun care products developed for this audience should take this into account and offer multifunctional solutions that can help to minimize photodamage and hyperpigmentation. While there has been improvement in creating sunscreens that work for more skin tones, it’s clear that there’s an opportunity for brands to continue to innovate with formulas and benefits that appeal to the needs of this audience.

MEN'S SUNSCREEN

Men’s skin care is a growing market due to it being a less crowded space and an increase in interest in skin care by men. GWI’s The Connecting the Dots 2022 report states that beauty and cosmetic products have represented the “fastest-growing interest” among male consumers, increasing by 21% between 2018 and 2021. While not every man’s skin is the same, men’s skin may have some general differences to women’s skin that can be important to consider when developing products for this audience. Men tend to have thicker (+20-30%) skin with higher collagen density. They also tend to have larger pores and higher levels of sebum or oil production than women, which can make non-comedogenic or oil-free and matte sunscreens more appealing. Additionally, men tend to shave their faces which can lead to more sensitive skin and irritation and require sunscreens that will not further exacerbate skin irritation.

It’s also important to note that alongside a rise in skin care for men, we’ve seen an increase in unisex products as younger audiences are increasingly gender-fluid and less restricted by gender norms than previous generations. The Gen Z Fashion Report indicates that 65% of Gen Z shoppers believe that their online shopping experience could be improved if there was a “gender neutral” search option, showing their view and preference for a genderless shopping experience. This is translating to the beauty aisle as skin differences between genders are often minimal and can vary across the spectrum. When developing unisex sun care products, brands should focus on solutions for skin types and concerns, and embrace formats and finishes that best appeal to their audience’s lifestyles.

KID'S SUNSCREEN

When it comes to sunscreen for children, parents are looking for safe and effective SPF protection in long-lasting formulations that are in formats that make it fun and easy to apply and reapply. Moisturizing and non-irritating ingredients are also important, especially for younger children and babies who may have more sensitive skin. The first step to sun protection is application but this is also one of the biggest challenges for parents when it comes to protecting their kids from harmful UV rays. Brands can innovate in this space with more playful textures and formats like jellies or mousse and incorporating elements like glitter and color to appeal to younger audiences.

At Prime Matter Labs, our mission is to make contract manufacturing better for brands. We believe the relationship between a contract manufacturer and a brand is a partnership where we collaborate to bring their unique idea to life and to shelves. Jennifer Hurtikant, Prime Matter Labs Chief Science Officer says, “Innovation is a team effort. Brands should continue to challenge science with creative concepts. When working with the right teams, those creative concepts can be achieved. Partners should include an innovative formulation team, a manufacturer that specialize in sunscreen products, a packaging engineer that can help source a unique component compatible with the formula, and a regulatory expert that ensures compliance throughout the R&D and production process. The simultaneous collaboration between these partners will ensure innovation, quality, and on time delivery to meet your consumers’ needs.”

Download a PDF of the full report by HERE.

For more beauty trend inspiration, check out our 2023 Beauty and Personal Care Trend Report.

Prime Matter Labs offers tailored product development and production, adapting and innovating along with your business. Work with our team to capture exactly what it's going to take to meet your consumers’ unique needs. Contact your Prime Matter Labs Project Manager or start your project here.